NYS Salary Threshold Changes Effective 1/1/24

* UPDATE: US Dept. of Labor published a final rule on April 23, 2024 increasing salary thresholds for those exempt from overtime eligibility as well as thresholds for highly compensated employees.

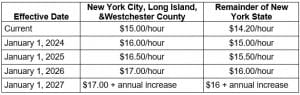

Employers are reminded that the next New York State minimum wage increase to $15.00 per hour was effective January 1, 2024, rather than December 31 as it has been in the past. This rate applies to employers who are outside of the NYC, Long Island, and Westchester County areas. In addition, NYS has issued a schedule of upcoming increases across NYS for the next several years. See chart below.

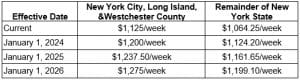

Then in addition to the minimum wage increase, the NYS salary threshold for the executive and administrative exemptions also increased January 1, 2024 to $1,200 per week for those in the NYC, Long Island, and Westchester County areas and $1,124.20 per week for employers located outside those areas. Further increases will occur as noted in the chart below.

While the NYS exempt salary threshold does not apply to the professional exemption, the federal Fair Labor Standards Act (FLSA) exempt salary threshold applies to most jobs that fall under the professional exemption category and is currently $684 per week. Jobs such as teachers, doctors, and lawyers do not have a salary requirement. However, starting July 1, 2024, the federal threshold will be increasing to $844/week, then increasing again to $1,128/week effective January 1, 2025. The next scheduled increase will be on July 1, 2027 with the amount determined in a similar fashion as the previous thresholds and is expected to change every 3 years thereafter. The DOL published a helpful chart outlining the various changes.

Greater Rochester Chamber members with questions on these changes can contact the HR Helpline staff for assistance: Jennifer Suppé, Manager, Organizational Culture and HR Services, MSHRD, PHR, SHRM-CP at (585) 256-4608, Cindy Owen, HR Services Partner at (585) 256-4606, or Kathy Richmond, Sr. Director, HR Services at (585) 256-4618. HR Helpline access varies by Membership tier.